Key Statistics

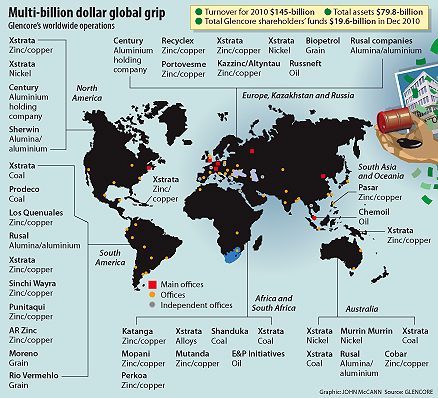

Employees: 57,000 world wide

Turnover in 2010: $145Bn

Assets owned: $79Bn

Profits: $5.19Bn (2007), $4.75Bn (2008), $2.72Bn (2009)

Headquarters: Baar, Swizterland

Key People47,48

(Note: these people’s ownership stake makes them larger shareholders than the institutional investors.)

Ivan Glasenberg, CEO since 2002. Owns 15.8% of Glencore, making him a billionaire many times over; has been with Glencore since 1983.

Willy Strothotte, Chairman; engineered takeover from Marc Rich; with Glasenberg he is a key player in the Glencore’s expansion and strategy; board member of Century Aluminum & Xstrata. It is believed he wants to see Glencore take complete control of Xstrata. Also a director of Minara, the second biggest Australian nickel producer.

Steve Kalmin, CFO since 2005. Owns 1%; joined 1999.

Daniel Francisco Mate-Badenes, joint head of zinc, copper & lead divisions. Owns 6%; joined Glencore 1988; director of Volcan, the Peruvian zinc & silver miner.

Aristotelis Mistakidis, joint head of zinc, copper & lead divisions. Owns 6%; joined 1993; director of the Katanga, Recylex and of Mopani subsidiaries.

Tor Peterson, director of coal & coke operations. Owns 5.3%; joined 1992.

Alex Beard, director of oil division. Owns 4.3%; joined 1995.

Simon Murray, newly appointed chairman following floatation. Background as senior executive at leading Hong Kong based companies, including managing director of industrial giant Hutchison Whampoa.49 He is also noted for his anti-women and other controversial statements.50,51 He has invested in Glencore and has business relationships with Nathaniel Rothschild.52 Director of Richemont (luxury goods) and of Cheung Kong; until 2010 was director of Vodafone, known for its tax avoidance tactics.

Tony Hayward, a non-executive director. Former head of BP during the Gulf of Mexico disaster. There are a number of other non-executive directors, who are noted for their ability to open doors to lucrative markets.53

Key Investors

Following the recent share-issue Aabar Investments with $1bn invested is the single largest investor; it is a state-owned sovereign fund of Abu Dhabi. The Government of Singapore Investment Corp. Pte. Ltd, is the second largest single investor with $400m. Other investors are mainly banks and asset managers, though the Zijin Mining Group of China is also listed as a cornerstone shareholder.54

Commodity Brokerage

A commodity is anything that can be bought or sold, whether on public exchanges or in private deals. The big commodities are those goods such as grains or metals that form the basis for various industries. A brokerage, such as Glencore, facilitates these trades, linking up the producer of the raw materials with the factories etc. which use or distribute them. They are a secretive but vital part of the capitalist process, forming a crucial link between industries. Profits for such brokerages depend on exploiting differences in the market, buying low and selling high for instance, or making bets on whether the market is going to go up or down.

While they present themselves as a necessary evil to make things happen within capitalism, the size of Glencore indicates that they dominate and distort the process. Rather than serving the market they are coming to dominate it and thus control prices – a system which brings great wealth for very little real value creation.

The importance of commodity markets has been intensified by the 2008 financial crisis. From 2003 to 2008, the commodities future market grew 1900%, from $13Bn to $318Bn55. Part of this is a shift out of stocks and shares to capitalise on increased growth in China and on natural disasters, which are helping push up the prices of basics. Brokerages such as Glencore make their money from trading on shortages and have to take their cut, so creating a spiral of price increases. As they become more powerful they can change the markets to suite themselves, keeping prices high by restricting supply and thus squeeze more money out of the end users. Rather than deal on the open markets, the main business deals are done in private, away from scrutiny.

While Glencore is a large owner of assets, what it really does is brokerage – in this case, it is the buying and selling of metals, coal, oil, grain. Of course, its many interests facilitate this, facilitating their access to the basic goods and controlling just how they enter into the world market. One way it does this is through ‘offtake’ agreements, where it acquires exclusive rights to purchase a company’s output, often companies in which it has a significant state – for instance, it owns over 50% of Singapore listed Chemoil Energy, the leading global supplier of marine fuel, and with which it has a deal giving it ‘preferential’ access to its facilities and fuel.

This sort of brokerage is dependent on having the right information in order to place a huge bet on whether prices are going to go up or down. Glencore’s vast network puts it ahead of the game, and there are numerous deals were it appears to have insider information, for instance around the ban on exports of Russian grain in 2010 following the huge fires that destroyed crops there. Belgium has already charged a number of Glencore employees with criminal conspiracy and corruption following bribery attempts – information was sought on EU export subsidies from an official.

The sheer size of Glencore also allows it to dominate markets to the point where it starts to set the prices. For example, when zinc prices started to fall, Glencore’s response was to shut its mines at Los Quenuales in Peru. Keeping prices up is always going to be a good way to make profits, though large profits can be made by having the right bets in a highly volatile market, which works best when there is access to inside information. When this is about basic foodstuffs, there is going to be a direct impact is going to be on the poor. Given its position in world markets, Glencore cannot avoid being directly implicated in the rise in food prices that are happening globally and profiting directly from the poor as a result.

_______________________________________________________________

Sources:

1. History, the website of Century Aluminum

2. Century Aluminum Co. (CENX) Major Holders, Yahoo! UK & Ireland Finance

3. Logan W. Kruger: Executive Profile & Biography, Business Week

4. MineWeb

5. Choc v. HudBay & Caal v. HudBay

6. Kyrgyz Kumtor Mine Controversy Heat Up, The Central Asia-Caucasus Analyst, 3 May 2008

7. Tricky Digs: With Easy Nickel Fading Fast, Miners Go After the Tough Stuff – Inco Tries Again at ‘Goro’ Site Using Acid and Heat; Protests in New Caledonia – Company’s Trucks Go Missing, ECA Watch, originally in The Wall Street Journal, 12 July 2006

8. About us, the website of En+

9. Rothschild keen for a merger of Glencore and Xstrata, UK Reuters, 9 July 2010

10. Glencore-Xstrata union would shake up a mining industry in hibernation, The Globe and Mail, 29 July 2010

11. Xstrata, Wikipedia, the free encyclopaedia

12. Xstrata Dreaming: The Struggle of Aboriginal Australians against a Swiss Mining Giant, CorpWatch, 16 February 2009

13. About Wybong Action Group, the website of WAG: Wybong Action Group

14. Glencore: Profiteering from hunger and chaos, 9 May 2011

15. Glencore’s share of global commodity markets, The Telegraph, 15 April 2011

16. Worldwide Operations, vefsíða Glencore International

17. Womb cancer cases in Jujuy, 31 March 2010

18. “Es grave lo que está pasando en la Puna”, Observatorio Latinoamericano de Conflictos Ambientales, 5 April 2007

19. FALLECE EL COMPAÑERO ORLANDO “CONEJO” VARGAS, Jujuy Contaminada, 30 March 2010

20. Board of Directors, Minara Resources

21. Xstrata’s Mt Isa Mines tops list of polluters, Brisbane Times, 31 March 2009

22. Sinchi Wayra workers request nationalization, Business News Americas, 21 August 2009

23. Glencore lays off hundreds in Bolivia: state news, Retuers, 26 December 2008

24. Involvement of Credit Suisse in the global mining and oil and gas sectors, Jan Willem van Gelder, June 2006

25. El lado obscuro de la minería en Colombia, Sviss Info, 6 December 2010

26. DEFENDAMOS A LA JAGUA DE IBIRICO DELA CONTAMINACION DE LAS MINAS DE CARBON, Centro de Medios Independientes de Colombia, 5 April 2006

27. UPDATE 3-Workers strike at Glencore coal mine in Colombia, Reuters Africa, 17 June 2010

28. Special report: The biggest company you never heard of, UK Reuters, 25 February 2011

29. Glencore float is hit by new allegations, The Daily Mail, 2 May 2011

30. Glencore accused of rights abuses in Congo, Swiss Info, 12 March 2011

31. Brot Für Alle

32. Dan Gertler, SourceWatch

33. Glencore’s Kazakh partner may invest $3.2bn gains in gold IPO, The Telegraph, 10 May 2011

34. Latin American Update, Mines and Communities, 22. september 2007

36. Mining in the Philippines – Mining or Food, R. Goodland & C. Wicks, Business and Human Rights Resource Centre, Feb 2009

37. RUSAL

38. MineSite

39. GLENCORE’S DISCLOSURES LEAVE RUSSIAN BUSINESS IN THE DARK, ESPECIALLY GLENCORE’S LOSSES, Business Insider, 11. maí 2011

40. Russneft, vefsíða Glencore International

41. Mwana Africa’s Bindura in off-take deal with Glencore, Reuters Africa, 7. febrúar 2011

42. Zambia’s miners paying the price, Mines and Communities, 12 October 2005

43. Greed Inc: A special investigation into pollution, dubious tax practices and exploitation of African workers at Glencore, Mail Online, 4 May 2011

44. Sherwin Alumina, Homefacts

45. Hazardous Substances Research Centre, 2007

46. M.a. Moreno, the website of Glencore International

47. Dow Jones Commodities News, 4 May 2011

48. The six Glencore billionaires…and one multi-millionaire, The Telegraph, 6 May 2011

49. Profile: Simon Murry, The Telegraph

50. Glencore chairman Simon Murray criticised for sexism, The Telegraph, 25 April 2011

51. Glencore’s Simon Murray: ‘England today looks economically absolutely shambolic’, The Telegraph, 24 April 2011

52. The very real elephant in the Glencore room, The Telegraph, 30 April 2011

53. Murray heads Glencore’s all-star board, Financial Times, 14 April 2011

54. Financial Times og various sources, May 2011

55. Glencore: One corporation’s power over life and death, LEAP – the Left Economics Advisory Panel, 4 May 2011

What a nasty piece of company this Glencore monster is!

Thanks a lot, Dónal, for providing us with an insight into this terrifying shadow-cave of the mining business.

A bit of an update:

“Century Aluminum Co said in a news release on Tuesday that Logan Kruger, its Chief Executive since December 2005, resigned and filed a lawsuit against the aluminum producer, alleging a breach of contract and wrongful termination.

The company said the claims were without merit and it intends to “vigorously defend itself against them,” without elaborating.

Requests from the primary aluminum producer for addition information about Kruger’s termination went unanswered.

Century Aluminum named Chief Financial Officer Michael Bless as acting president and chief executive, replacing Kruger.”

Read the whole article here: http://www.reuters.com/article/2011/11/15/aluminum-centuryaluminum-idUSL3E7MF2LL20111115

if you can’t beat them, join them. or, infiltrate them. not dismissing the corruption and human tragedies, but it would seem that the best way to dismantle them would be from the inside out

Donal

Fantastic article. I have referred to this post on my blog re. Glencore, the WFP and Africa today, in relation to food aid.

Keep up the good work.

Here is a bit more about above-mentioned Lewis “Scooter” Libby, from an interesting article on Libby on the one hand, Bradley Manning on the other:

“After 9/11, I. Lewis “Scooter” Libby, a Yale graduate with a law degree from Columbia, and fellow neo cons plotted to twist and invent “intelligence” data to convince the public that Saddam Hussein possessed weapons of mass destruction, so as to build a case for invading Iraq.

From 2001 to 2005, Libby served as Assistant to the

Vice President for National Security Affairs, Chief of Staff to the Vice President of the United States and Assistant to President George W. Bush.

Libby and fellow neo cons stressed Bush’s dubious claim that “the British government has learned that Saddam Hussein recently sought significant quantities of uranium from Africa.””

The full article is here: http://dailycensored.com/2012/03/08/scooter-libby-v-bradley-manning-malice-v-nobility/

Incredible bastards. Your work provides wind to my ailing wings. Any info as it relates to Latin America is appreciated. I am a gonzo style journalist. The last three years researching the energy sector and now beginning to publish. Sign the pledge to give Earth legal rights. Mac.

B.E. Macomber, I hope that you will include in your gonzo journalism that the people who run such multinational corporations like Alcoa that produce materials for the cancerous military industrial complex, the politicians who are bribed by such companies and then work for them after they retire from politics (the proverbial revolving door), the construction companies that benefit from these projects and the international banks that loan them all money based on a fake fiat system of finance are nothing but parasites that must be removed from the body of humanity before they destroy us all and the planet. They have had their hand in the cookie jar for way too long.

People have to use their critical thinking skills and not believe the bullshit or reindeer dung (as you would have there in Iceland) these parasites tell you. They profit first, the people and the communities, very little and usually never. You will be left holding a huge debt as John Perkins (Confessions of an Economic Hit Man) will educate you on and then, you will have to sell your natural resources for pennies on the dollar or aurar on the krona as you might say there.

I have been to Iceland many times and have friends in Husavik. You may think your community will thrive, but, these parasites will destroy your beautiful nature and tourism industry and then, after they have depleted your natural resources and irrevocably destroyed your country, they will pull out (and they always do), and you will have nothing left, only generations of diseased and dying Icelanders from the by-products of the aluminum production and the extinction of natural species that only God himself could have given you.

I no longer use aluminum foil or drink soft drinks contained in cans produced by these genocidal multinational corporations. If everyone tuned out of “The Matrix” the illusion that you think is real and turned on to how these bastards operate, we could effectively put them out of business cause there would be no more demand for their products. That is the only way.

Thank you Dónal.

Canada’s federal government just gave the go ahead for Glencore’s bid to acquire Regina-based grain handler Viterra Inc.

http://www.theglobeandmail.com/report-on-business/glencore-international-receives-federal-approval-for-viterra-acquisition-bid/article4418018/

“You must see these gruesome photos because they represent what is happening in Tampakan, South Cotabato where Xstrata-SMI has an application for a mining project. Members of a family leading the opposition against the mining project were killed in cold blood. Could they be a symbol of our brand of ‘development’, which is for government and for multinatinals, not for Filipinos?”

http://www.sisterraquel.com/2012/10/eastwind-journals-46-the-tampakan-massacre/

Century Aluminum Holds West Virginia Retirees Hostage in Exchange for Cheap Power:

http://truth-out.org/news/item/15108-corporate-giant-century-aluminum-holds-west-virginia-retirees-hostage-in-exchange-for-cheap-power